- BlockchainIST Insights

- Posts

- BlockchainIST Insights

BlockchainIST Insights

Issue #63

Welcome back to BlockchainIST!

We decode the complexities of blockchain and crypto-economics with precision and poise. As a research center committed to revealing the entanglements of this dynamic domain, we are delighted to present you with a curated collection of insights, analysis, and cutting-edge research.

📰 TOP NEWS

Institutions now hold over 10% of the entire Bitcoin supply, and their daily buying demand is outstripping new Bitcoin issuance by a factor of 10x.

“Driven by ETFs, corporate treasuries, and trusts, this explosive institutional interest has significantly tightened Bitcoin's available supply and historically aligns with sharp price spikes, signaling a bullish structural shift in the market.”

Under the newly enacted GENIUS Act, JPMorgan is exploring offering loans collateralized by crypto, such as Bitcoin and Ethereum, marking a strategic shift in traditional banking.

"This move transforms crypto from speculative assets into usable financial tools, enabling clients to access liquidity without selling positions. It shows JPMorgan embracing regulated crypto services.”

DogeOS has proposed a protocol upgrade that would enable Dogecoin to natively verify zero-knowledge proofs (ZKPs), unlocking support for zk-rollups, DeFi, gaming, and EVM-compatible applications while preserving network simplicity.

“This marks a pivotal transition for Dogecoin from a meme-based payment chain to a scalable, interoperable platform. This shift could significantly boost its ecosystem utility if the soft-fork proposal gains consensus; execution limits ensure upgrades don’t compromise speed or compatibility.”

Solana Labs, the Solana Foundation, and Jito Labs have been named in an amended U.S. class-action lawsuit under the RICO Act, accused of facilitating a $1.5–$5.5 billion unlicensed “slot machine”-style fraud via the Pump.fun memecoin platform.

“This lawsuit marks a pivotal escalation in legal scrutiny: infrastructure providers traditionally seen as neutral are now facing claims of active participation in illicit activity, potentially setting a precedent for holding blockchain ecosystems legally accountable for the behavior enabled by their platforms.”

📌 REMARKS OF THE WEEK

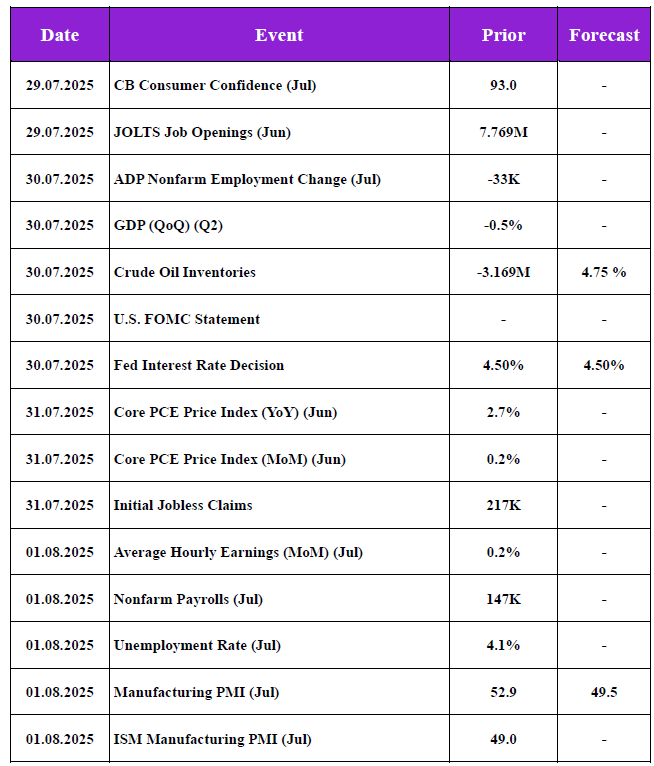

Source: investing.com

🔐 CRYPTO UNLOCKS

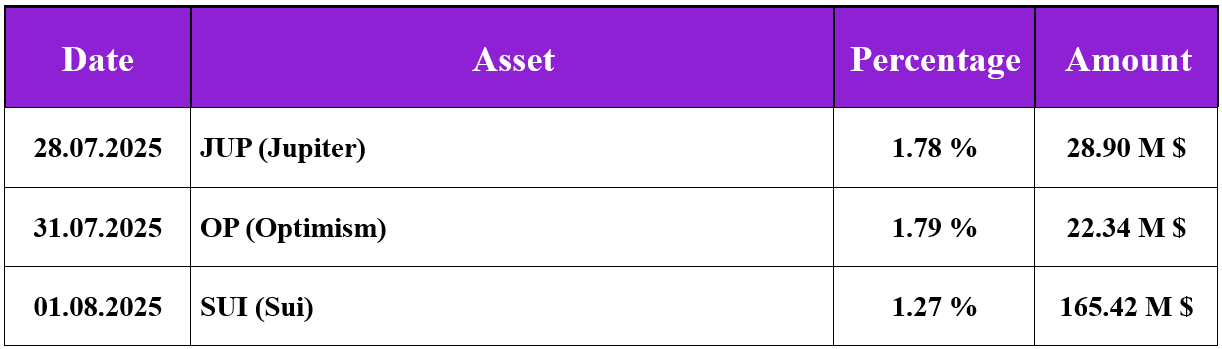

Source: tokenomist.ai

🎟️ EVENT OF THE WEEK

The Science of Blockchain Conference 2025

The conference focuses on technical innovations in the blockchain ecosystem, and brings together researchers and practioners working in the space. They aim to foster collaboration among the different communities working on blockchain protocols, cryptography, distributed systems, secure computing, and crypto-economics.

Date Aug 4-6

💬 EXPERT OPINION

In my mind we are at the very beginning of a ‘tokenization of everything’ where every form of asset, every form of value storage, every form of important record becomes a crypto token.”

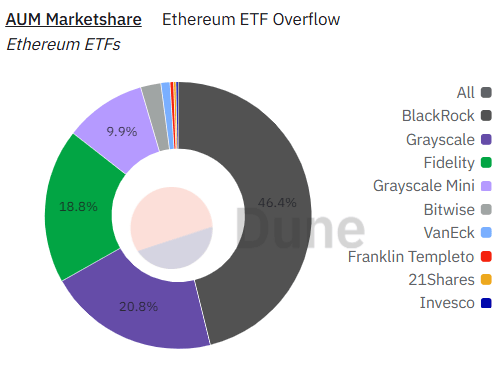

📊 METRIC OF THE WEEK

Our researchers designed this metric with ❤️

GLOSSARY CORNER Tokenized assets are physical or digital assets represented digitally on a blockchain. This process, called tokenization, creates a digital token that represents ownership or a stake in the underlying asset, whether it’s real estate, stocks, commodities, or intangible assets like intellectual property. | EDITOR’S CHOICE • THE TOKENIZATION OF EVERYTHING (video) |

Stay Informed, Stay Ahead! Subscribe to Blockchain Insights Today!

Don’t miss out on the latest developments in blockchain and crypto-economics. Join our community of enthusiasts, investors and researchers by subscribing now.

Explore the future with us!